A Happy New Year to you and all your family!After a year and a decade of disaster for our country, 2010 is a year of hope and opportunity for us all because this year the people of East Renfrewshire and the UK will get their chance to elect a government with a vision for the future.

For me this means we need change, real change and the sort of change only David Cameron and the Conservatives as offering.Why so? Well not because Labour, in the form of Tony Blair, boast the first Prime Minister in British political history to have misled parliament into sending our troops to war, nor is it simply because East Renfrewshire has suffered greatly under Labour rule for nearly 15 years.

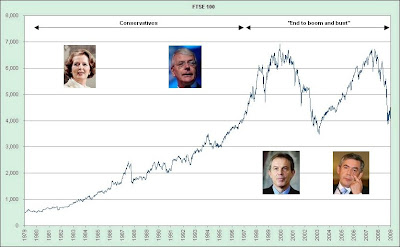

It is because Labour are led by Gordon Brown who led us into the economic recession that is hitting East Renfrewshire so hard.Want proof? Well here are just 10 financial mistakes made on Gordon's watch, all of which helped the UK achieve the unenviable distinction of being the first major economy into and the last major economy out of recession - hardly making us the "best placed" major economy in the world as Gordon Brown would have had you believe:

1. Ruining Our Pension Funds by Abolishing Taxing Dividend PaymentsBefore 1997, dividends issued by UK companies and paid to pension funds were tax-free - that is, the tax could be claimed back via a system of tax credits.

Immediately after Labour's election in 1997 Gordon Brown decided this system would be abolished. Tax relief was scrapped, reducing the amount collected by pension funds by around £5 billion a year.Pension funds holding the cash that you, me and almost everyone else in the country making provision for old age plan to use for our retirement have lost around £100 billion over the last 12 years. One big stealth tax that decimated a UK pensions industry that was once considered to be the best in the world.2. Selling "OUR" GoldIn May 1999 Gordon Brown planned to sell some gold. There were two problems with this, which concerned his advisers. The price of gold had slumped after a decade of stagnation, but was likely to increase in the proceeding years. Added to this, the announcement of a major sell-off would drive the price down further. Not that this deterred the Chancellor.

Experts believe that the poorly timed decision to flog our national treasure has cost us all around £3 billion.3. Establishing Inadequate Regulation

The system of financial regulation dividing powers between the Treasury, the Bank of England and the Financial Services Authority, established by Gordon Brown as Chancellor in 2000, missed what amounted to the biggest financial crisis of our lifetime. Today most sensible and respected commentators conclude that the system set up by Gordon Brown failed and should be replaced.

The Commons Treasury Select Committee’s report on the collapse of Northern Rock said that the Financial Services Authority had “systematically failed in its duty” to oversee the troubled bank’s activities. Little did it realise that Northern Rock was not alone and only a tiny tip of a titanic sized iceberg.

4. Creating a Complicated Tax Credit SystemWhile the tax credit system works for some there is no doubt it is too complicated and prone to mistake.

Take the example of Simon Blackmore, 38, who was pursued for £6,057 in over-paid tax credits. He says, “Gordon Brown claims the tax credits system lifts children out of poverty, maybe it does, but only to plunge them and their families into debt two years later.”

Millions of low-income families have had to pay back the Treasury after receiving too much money in tax credits, putting them under huge financial and emotional strain.

Meanwhile, 40 per cent of workers and families who deserved tax credits left billions of pounds unclaimed in the 2008-09 tax year for fear of being chased for the cash later on. Introduced in 1999, reformed in 2000, tax credits have been "a complete disaster zone", according to tax experts.

5. The £10,000 Corporation Tax ThresholdIn 2002, Gordon Brown introduced a new tax regime to help small businesses. He announced a new zero per cent rate of corporation tax on profits below £10,000. It was designed to boost the ability of small businesses to grow and prosper.

But instead of doing what it was intended to achieve it became a vehicle for massive tax avoidance as sole traders such as taxi drivers or plumbers found it became advantageous to turn themselves into limited companies to take advantage of the new rules.A Treasury Minister later commented that "the Government did not realise how many people would engage in abusive tax avoidance", despite the fact that it was "blindingly obvious" to tax experts "within 5 seconds" of the budget announcement that this would happen.

Gordon scrapped the rules a few years later, raising the rate from 0 per cent to 19 per cent when he released how much money was being lost.

6. Abolition of the 10p Tax Rate

Gordon Brown is not known for his apologies and very rarely admits "mistakes".

Over the abolition of the 10p tax rate in 2007, Mr Brown told Radio 4's Today programme that "we made two mistakes. We didn't cover as well as we should that group of low-paid workers who don't get the working tax credits and we weren't able to help the 60 to 64-year-olds who didn't get the pensioner's tax allowance."

Experts use stronger language to describe the Budget of 2007, which was designed to produce positive headlines for the 2p cut in income tax. Accountants calculated that the scrapping of the 10 per cent tax rate, coupled with the increase in the proportion of tax credits withdrawn from higher earners, would leave 1.8 million workers earning between £6,500 and £15,000 paying an effective tax rate of up to 70 per cent.

7. Failing to Spot the Housing Bubble

Gordon Brown said he ended boom and bust, and in those innocent days before the collapse of the global finance system many believed him.In 1997, he outlined his plans. "Stability is necessary for our future economic success", he wisely informed an audience at the CBI. "The British economy of the future must be built not on the shifting sands of boom and bust, but on the bedrock of prudent and wise economic management."

The other components of that bedrock including a trillion-pound debt mountain and a decade of unchecked and unparalleled house price inflation presumably slipped his mind.In 2003 a mild-mannered Liberal Democrat MP by the name of Vince Cable dared to question the mantra of "the end of boom and bust". He asked Gordon Brown: "Is it not true that...the growth of the British economy is sustained by consumer spending pinned against record levels of personal debt, which is secured, if at all, against house prices that the Bank of England describes as well above equilibrium level?"

Gordon replied: "The Honourable Gentleman has been writing articles in the newspapers, as reflected in his contribution, that spread alarm, without substance, about the state of the economy..."

We all know what happened next and it is Vince Cable who earns plaudits for having the foresight to question Gordon Brown's claims of infallibility. Credit where credit is due!

8. Creating a 50 per cent Tax Rate The Institute for Fiscal Studies has said the tax hike which heralded the end of the New Labour project may actually end up losing the Government money. "If you look at what happened when higher rates were last changed in the 1980s, that might lead you to suggest that such a move might actually lose you revenue, rather than gain it, as people actually declare less income for tax,". In the meantime significant numbers of high net worth individuals are abandoning the UK for lower tax economies depriving our exchequer of even more revenue.

9. Cutting VAT"It would be funny if it wasn't so serious," said a tax accountant when asked about the Brown-Darling brainwave to cut VAT by 2.5 percentage points.

As a nation of shoppers, rather than shopkeepers, a chopped down sales tax sounds like a good idea, providing a vital boost to hard-pressed families at a time of financial hardship. There were two problems. It costs £12.5 billion a year and it has made little discernible difference to those hard-pressed families because it is shopkeepers, rather than shoppers, who have pocketed much of the benefit.

10. Public-Sector Borrowing

If we had only saved a little more in the good times, we might have had a little more to fall back on in the bad. Last month saw public-sector net borrowing hit £19.9 billion, the highest on record, according to the Office for National Statistics. Alistair Darling has forecast Government borrowing will reach £175 billion this year.

It is forecast that total government debt will double to 79 per cent of GDP by 2013, the highest level since World War 2. The Institute for Fiscal Studies recently warned that "the scale of the underlying problem that the Treasury’s detailed forecasts identify will require two full parliaments of mounting austerity to repair.”

So here's to a year of hope, opportunity and change. I am sure East Renfrewshire is ready to play its part in setting our country on its way to recovery although, as I hope you can see, it is now inevitable we will all be paying for Gordon's gaffes for many years to come even in he leaves office in 2010.

George Osborne has published the entire Budget online, in an open and interactive format. So if you want to help pick apart Gordon Brown's deceptions - take a look at the documents and post us your comments (http://www.yourbudgetresponse.co.uk/).

George Osborne has published the entire Budget online, in an open and interactive format. So if you want to help pick apart Gordon Brown's deceptions - take a look at the documents and post us your comments (http://www.yourbudgetresponse.co.uk/).

The Financial Services Authority warned today that Britain's recession could go deeper and last longer than expected, despite the government's fiscal stimulus and multi-billion pound economic rescue plans.

The Financial Services Authority warned today that Britain's recession could go deeper and last longer than expected, despite the government's fiscal stimulus and multi-billion pound economic rescue plans.

.jpg)